India Receives Largest Private Equity Investment in Healthcare Sector in Asia-Pacific Region

- Healthcare and General Service

- July 17, 2025

Highlights

- In 2024, private equity and venture capital investment in India’s healthcare sector reached its lowest level since 2020, but prospects remain attractive due to the significant demand-to-capacity gap

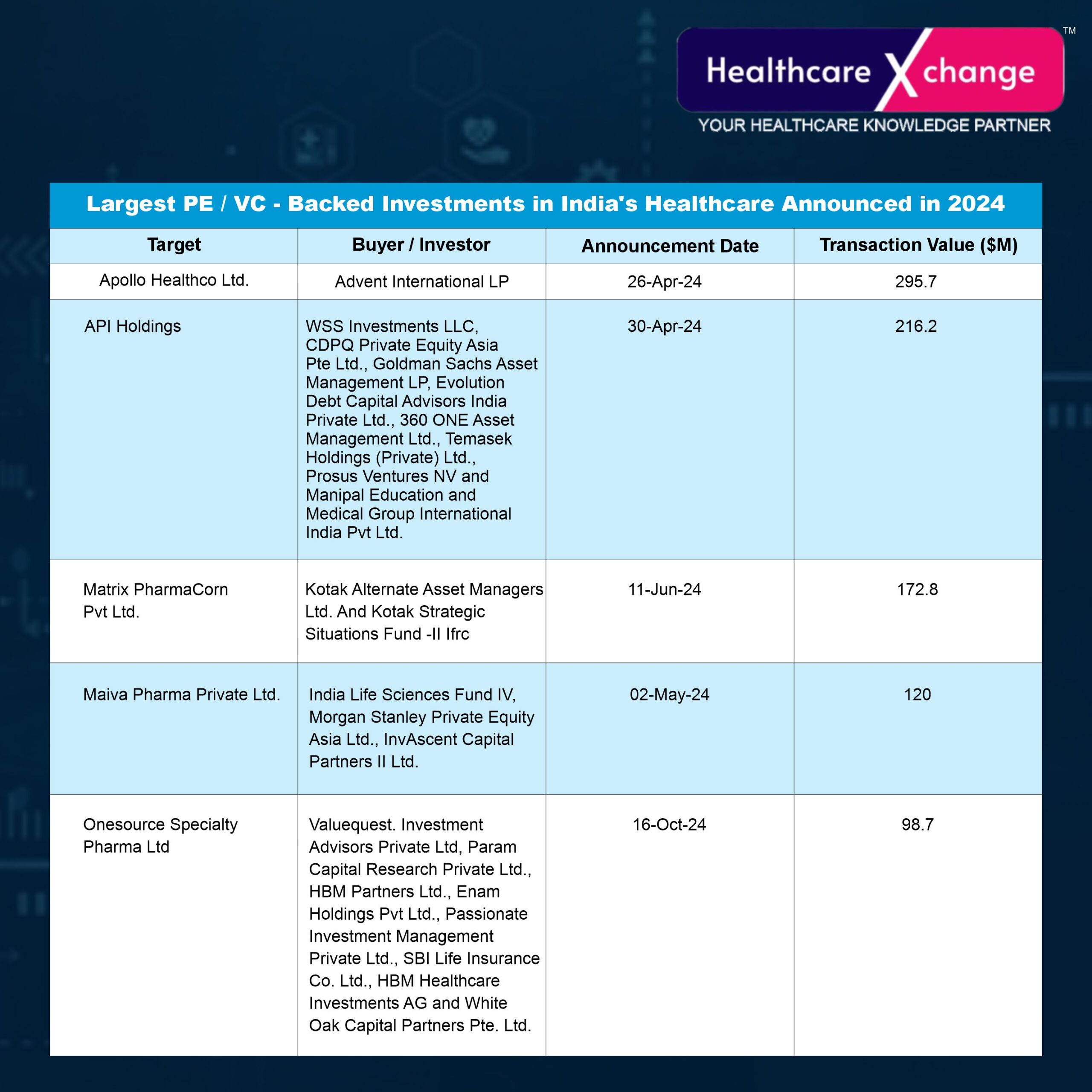

- Advent International LP invested USD 295.7 million in Apollo Hospitals Enterprise Ltd.’s subsidiary, Apollo Healthco Ltd., marking the largest private equity-backed transaction in India’s healthcare sector

India has emerged as the largest private equity buyout in the healthcare sector for the Asia-Pacific region. The Indian healthcare sector accounted for 26% of deal volume in 2024, according to a Bain and Capital report. However, the wider Asia Pacific market is experiencing a decline in buyout activity with regional volumes dropping by nearly 49%. India has bucked the trend and has been more resilient to downturns in this period. The country’ buyout volumes fell 18% from 2023 compared to the overall drop.

The healthcare sector’s favourable prospects are driven by strong capital markets, economic fundamentals, and increased investor confidence. Successful private equity exits like Advent International’s BSV Group sale have further validated India’s buyout market as an attractive prospect for future investment.

India’s healthcare sector is expected to register strong growth in the next three years, with spending likely to touch USD 320 billion by 2028. Over the past two years, investments have primarily focused on provider deals, particularly in hospitals, clinics, and supporting services, with a sharper focus on biopharma services.

India has consistently been a preferred investment destination in the last five years with favourable returns and successful exits for PE firms via public offerings, strategic acquisitions, and sponsor-to-sponsor deals. The country’ hallmarks include strong macroeconomic fundamentals and a varied healthcare landscape, mitigating systemic risks.

Advent International LP invested USD 295.7 million in Apollo Hospitals Enterprise Ltd’ subsidiary Apollo Healthco Ltd., the largest private equity-backed transaction in India’s healthcare sector. Moreover, Prosus Ventures NV and Temasek Holdings led a USD 216.2 million funding round for pharmaceutical and cosmetic products distributor API Holdings Ltd.

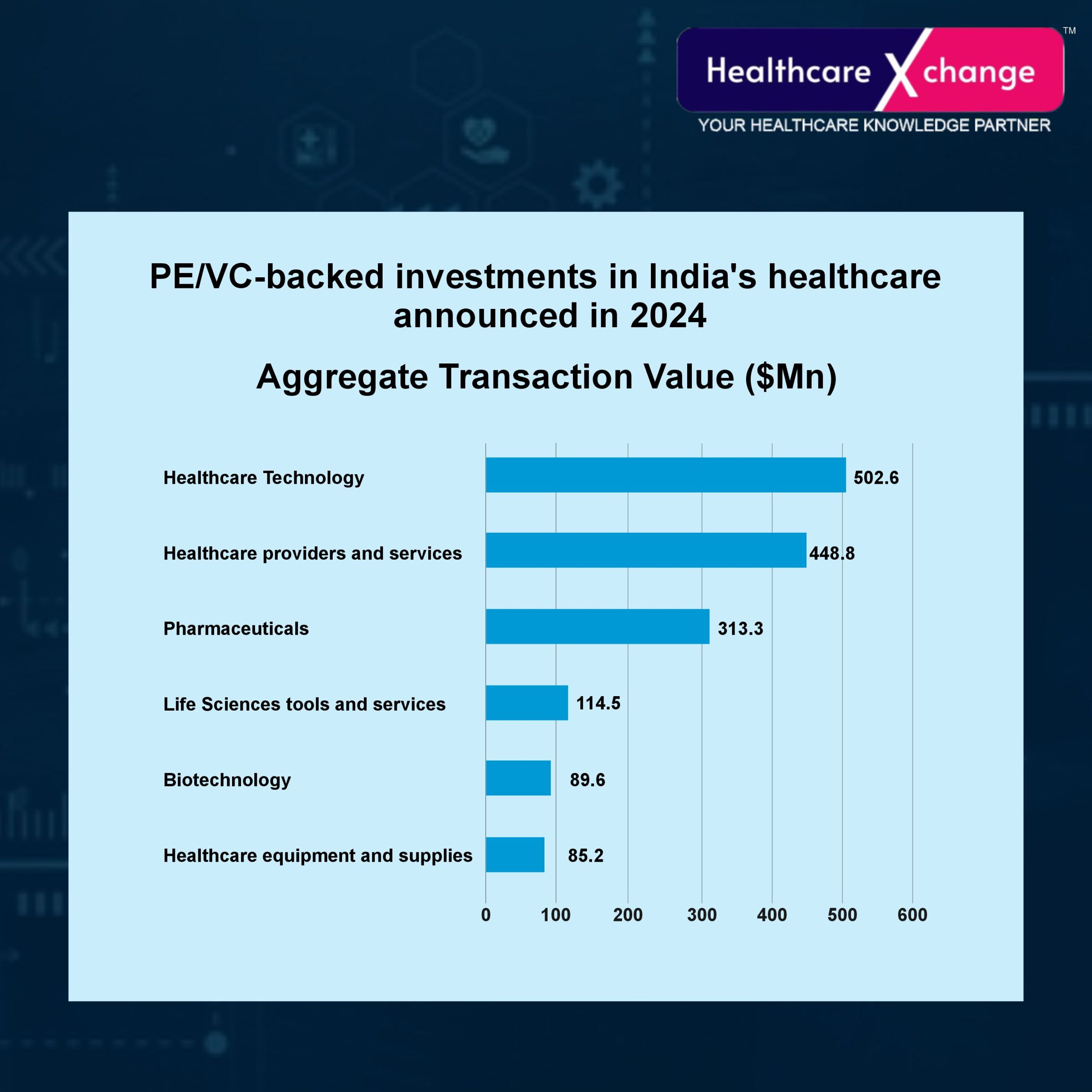

Healthcare technology received the largest private equity-backed funding totaling USD 502.6 million among healthcare segments in 2024. Healthcare providers and services came in next at USD 448.8 million.